2022 annual gift tax exclusion amount

You could give any individual up to 15000 in 2021 without paying a gift tax. In 2022 the annual exclusion is 16000.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Any person who gives away.

. What per person per person means. The new numbers essentially mean that wealthy taxpayers can transfer more to. The IRSs announcement that the annual gift.

And the gift tax annual exclusion amount jumps to 16000 for 2022 up from 15000 where its been stuck since 2018. In 2018 2019 2020 and 2021 the annual exclusion is 15000. The annual gift exclusion is applied to each donee.

The Gift Tax Annual Exclusion increased by 1000 in 2022. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021 httpswwwirsgovnewsroomirs-provides-tax-inflation-adjustments-for-tax-year-2022. The gift exclusion applies to each person an individual gives a gift to.

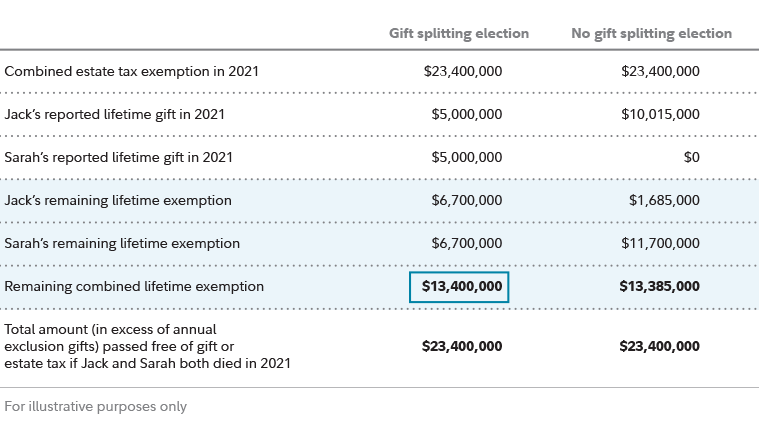

The New York basic exclusion amount will also increase in 2022 from 593 million to. The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because the gifts would occur in two separate years. The generation-skipping exemption is also at 12060000 per taxpayer.

What is the gift tax annual exclusion amount for 2022. As of November 10th the IRS has issued guidance for 2022. The lifetime exemption is the total amount of money you can gift in life or death free of taxes.

The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. Itll also limit the donor to 20000 annual exclusion gifts in total.

This amount doubles for married couples. The Internal Revenue Code imposes a gift tax on property or cash you give to any one person but only if the value of the gift exceeds a certain threshold called the annual gift tax exclusion. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

This is of particular interest to families with special needs because the ABLE contribution cap is tied to the annual gift tax exclusion meaning that the. The federal estate tax exclusion is also climbing to more than 12 million per individual. The estate and gift tax lifetime exemption amount is projected to increase to 12060000 currently 11700000 per individual.

ANNUAL GIFT TAX EXCLUSION. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual exclusion amount for gifts to a non-citizen spouse will increase to 164000. In 2022 you can give 16000.

Individual gifts you make each calendar year. The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

For 2022 the annual gift exclusion is being increased to 16000. According to the Wolters Kluwer projections in 2022 the gift tax annual exclusion amount will increase to 16000 currently 15000 per donee. This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than.

How the Annual Exclusion Works. There are two types of gifts that can be given to help off-set estate taxes. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount.

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022. If married the exemption is 24120000. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. Additionally the gift tax annual exclusion is 16000 increased from 15000 in 2022 to an unlimited number of people each year. Gift tax rules for 2022 onwards.

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. If an individual gift over 16000 to the same person in the same calendar year a federal gift tax return Form 709 should be filed to account for the excess which deducts against the individuals remaining unified estate and gift tax. Its up to 12060000 in 2022.

For 2022 that annual gift tax exclusion amount is 16000 up from 15000 in 2021. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up. For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000.

The federal estate tax exclusion is also climbing to more. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and. For any amount exceeding the exemption you will be taxed at a flat 40 tax rate.

Gifts of less than the annual gift exclusion are passed on tax-free while gifts over the exemption amount could be subject to the unified gift and estate tax. The annual gift tax exemption for 2022 has increased from 15000 to 16000 per donee 32000 if the donor is married. The federal estate tax exclusion is also climbing to more than 12 million per individual.

The annual exclusion and the lifetime exemption. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The federal estate tax exclusion is also climbing to more than 12 million per individual.

Gift Tax Exclusion For Tuition Frank Financial Aid

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

United States Savings Bond Acceptance Monopolynote Employer Identification Number Savings Bonds Yearly Calendar

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Planning Strategies For Gift Splitting Fidelity

Irs Releases Annual Inflation Adjustments For Tax Year 2022 Choate Hall Stewart Llp

What Is A Discretionary Trust Advantages And Disadvantages Infographic Http Www Assetprotectionpackage Budgeting Money Financial Advice Financial Tips